This weeks home money tip manages saving. For over 25% of Americans, an investment account is non-existent in their lives. Albeit keeping for later isn’t something we like to do, it is one of the most fundamental monetary exercises to shield our future.

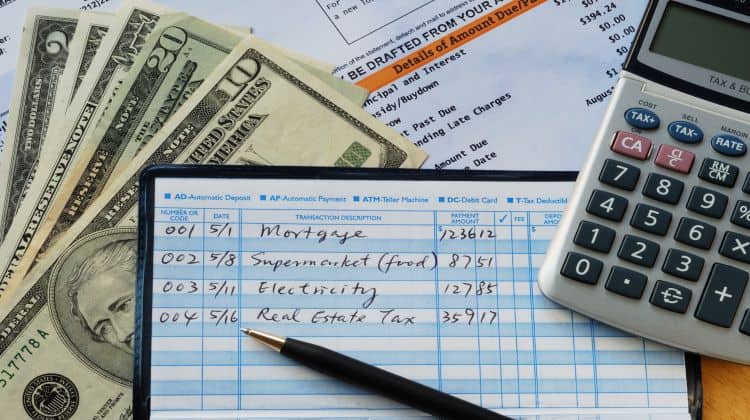

Monetary guides vary on how much cash we really want in our crisis reserves yet they appear to settle on a 6 to multi month range. How would you compute that? First you need to know the amount you spend every month. You will constantly gauge low so get your bank and financial records out and put it all together. Take that number and duplicate it by 8 months (or some place in that 6 to 10 territory) and that is your objective. When you’re there, keep it in an investment account. It can’t be restricted in a CD and you can’t risk losing it in the financial exchange. (Coincidentally, I unequivocally propose that you add handicap protection to your month to month expenses. It’s modest and assuming you became wiped out or harmed, the month to month bills will be insane)

Since it is now so obvious the amount you ought to save, you mind may be in overdrive pondering how you will finance your bank account. It will take discipline yet here’s a pleasant way that will place some enormous cash in your bank account after some time. You can consider it my Chick-fil-a technique. I love Chick fil a to some extent on the grounds that the food is great (hello chick fil a, are you perusing?) yet additionally on the grounds that they give out coupons constantly. I would have gone to Chick Fil an and followed through on full cost without the coupon yet with it, I saved $4. That $4 goes in to my bank account. Since I put all that on my Mastercard and take care of it toward the month’s end, I get rewards focuses. I generally purchase $50 present declarations with those places. Think about where that $50 goes? We should accept it somewhat further. As opposed to going to Chick Fil an and getting a chicken sandwich and waffle fries and an eating regimen coke for $9, I go to the supermarket and get a bunch of chicken bosoms and several potatoes and hydrate. In the first place, I’m saving calories however I likewise saved $5 by not eating out. I pressed my own shirt as opposed to taking it to the laundry, $2. So we should see; in this article alone I saved $70 and have a sizeable sum for my investment account.

Keep a multi week diary and see how you might pay yourself. It’s tomfoolery, it’s a test, and you will rest easier thinking about drawing nearer to your monetary objective. We are not in an economy where we can rely on having some work tomorrow. Business analysts anticipate that 1 out of each and every 10 working Americans won’t be working before this downturn is finished. Remember about the current week’s home money tip. Assuming you want it, you will be thankful that you have it.